Prop 19 Loans – Inherited Property Loans for Irrevocable Trusts & Estates in California

Irrevocable Trust Prop 19 Loans

Irrevocable trust Prop 19 loans allow for beneficiaries of an estate or an irrevocable trust to borrow against real estate assets. This allows the beneficiaries raise the needed funds to equalize a distribution or settle debts and expenses of the estate or trust. Prop 19 loans can be used in situations where one beneficiary wants to keep the inherited property while the other beneficiaries want their share in cash. The Prop 19 loan is made directly to the irrevocable trust or estate with the loan proceeds going directly into the bank account of the trust or estate.

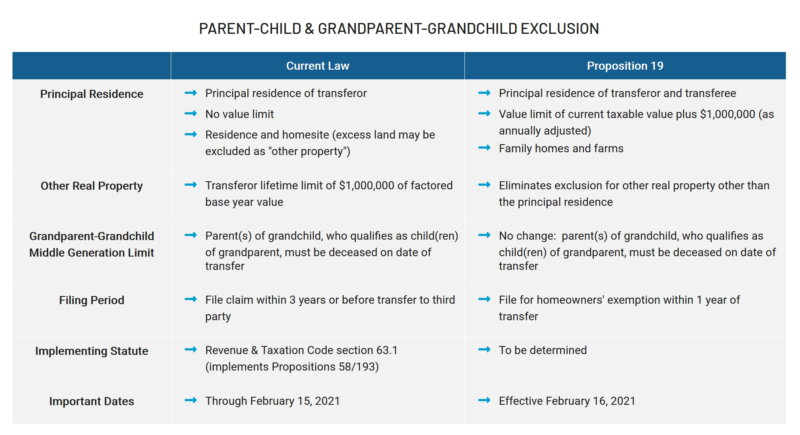

Prop 19 requires the beneficiary to maintain the property as a primary residence and only allows for preventing a reassessment on $1m of value (plus current taxable valuable). A loan for Prop 19 qualifies as a 3rd party loan to help equalize and distribute the trust or estate. Prop 19 loans are also known as trust loans or probate loans depending on the current ownership of the inherited property.

Property Equalization Loan for Trusts

Property equalization loans for trusts (or probate/estates) can allow for beneficiaries to apply for Proposition 19 and prevent a property tax reassessment. The property equalization loan helps provide the necessary distribution amount to each party and allows the ultimate real estate transfer to be considered as parent to child as opposed to sibling to sibling. The property equalization loan stays attached to the real estate when it is transferred to the beneficiary. Once in the beneficiary’s name, it can be refinanced into a long-term traditional loan or paid off with cash.

Proposition 19 Passed November 2020

Proposition 19 passed by a narrow margin in November 2020 on the California ballot. Proponents of Prop 19 advertised it as a benefit to wildfire victims and seniors but the real significance of Prop 19 would be the repealing of previously passed Prop 58 and Prop 193. While the “Yes on Prop 19” advertisements promoted the fact beneficiaries would be able inherit their parent’s real estate and prevent a property tax reassessment, they failed to disclose that the Prop 19 property tax reassessment benefits would be severely limited compared to the existing Prop 58 and Prop 193 benefits.

Source: California State Board of Equalization

See the California State Board of Equalization for additional information on Proposition 19.

Now that the dust has settled on the California election, many have discovered the actual ramifications of this proposition and some are looking to Repeal Prop 19.

The California Association of Realtors and National Association of Realtors donated over $40,000,000 to support the passing of Prop 19 which accounted for almost 100% of the donations. Without Prop 19, beneficiaries of inherited real estate are more likely to find themselves unable to afford the increase in property taxes and be forced to sell the property instead of keeping it in the family. More inherited properties being sold leads to more commissions for Realtors.

Donations for the opposition of Prop 19 totaled only $395,947.

*Consult a trust or estate planning attorney or CPA prior to proceeding with a trust or estate distribution. The information provided herein is for educational purposes only. North Coast Financial is not providing any legal, tax or financial advice.

Recent Estate, Probate and Trust Loans Funded by North Coast Financial

Probate & Trust Loans Resource Guide

California Probate, Estate & Trust Loan Request

We will contact you to review the loan scenario and provide a quote.